Becoming a CRNA is an investment in your future, but the financial strain of school, especially with little to no income, can make maintaining a strong credit score challenging. Your credit health impacts everything from loan approvals to future home purchases, so protecting it during school is essential. Here are ways to keep your credit in check while focusing on your education.

1. Make On-Time Payments (Even the Minimum)

Your payment history accounts for 35% of your credit score, making it the most critical factor (FICO, 2024). If you have student loans, credit cards, or any bills in your name, set up automatic payments to avoid missed due dates. Even paying the minimum can prevent damage to your score.

2. Use Credit Cards Wisely

If you rely on credit cards for living expenses, keep your utilization low, ideally under 30% of your credit limit (Experian, 2024). If you have a $5,000 limit, aim to keep your balance below $1,500 to avoid a negative impact.

3. Consider a 0% APR Credit Card or Balance Transfer

If you’re carrying a balance, look into 0% APR credit cards or balance transfers to reduce interest accumulation. Many cards offer promotional periods with no interest, helping you manage debt while in school (NerdWallet, 2024).

4. Avoid Opening Too Many New Accounts

While having credit is good, opening too many new accounts in a short time can hurt your score. Each new inquiry can lower your score by a few points (Equifax, 2024). Instead, focus on responsibly managing the credit you already have.

5. Communicate With Lenders if You’re Struggling

If you anticipate difficulty making payments, contact your lenders before missing a due date. Many creditors offer hardship programs, deferment, or forbearance options to help students manage temporary financial challenges (Federal Student Aid, 2024).

- — This was extremely helpful for me while in school. Many creditors were willing to place me on a payment plan. While this didn’t lower the accrued interest on the card, it did defer any negative marks on my credit score.

6. Monitor Your Credit Score Regularly

Check your credit report for errors or fraud using free tools like AnnualCreditReport.com. Many banks and credit card issuers also offer free credit score monitoring. Keeping an eye on changes can help you catch and fix issues early.

Final Thoughts

Your credit score is a long-term asset, even during school. By making strategic financial moves now, you can set yourself up for financial success as a CRNA. Prioritize on-time payments, responsible credit usage, and proactive financial planning to keep your credit score in good shape, so when your first big paycheck arrives, you’re ready to make the most of it.

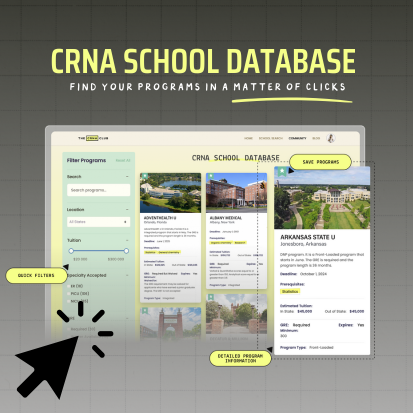

Want to learn more about preparing financially for CRNA school? We’ve got lessons and resources for you inside The CRNA Club Membership!